UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐Preliminary Proxy Statement

☐Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐Definitive Additional Materials

☐Soliciting Material under §240.14a-12

GITLAB INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐Fee paid previously with preliminary materials.

☐Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

May 15, 2023April 30, 2024

You are cordially invited to attend the 20232024 Annual Meeting of Stockholders of GitLab Inc. (the “Annual Meeting”). The Annual Meeting will be held virtually at http://www.virtualshareholdermeeting.com/GTLB2023GTLB2024 on Thursday,Tuesday, June 29, 202311, 2024 at 9:008:30 a.m. Pacific Time. We believe that a virtual stockholder meeting aligns with our all remote culture and enables participation from our global community.

The matters expected to be acted upon at the Annual Meeting are described in the accompanying Notice of Annual Meeting of Stockholders (the “Notice”) and this proxy statement (the “Proxy Statement”). The Annual Meeting materials include the Notice, Proxy Statement, our annual report to stockholders and proxy card, each of which has been furnished to you over the Internet or, if you have requested a paper copy of the materials, by mail.

Your vote is important. Whether or not you plan to attend the Annual Meeting, please cast your vote as soon as possible by Internet, telephone or, if you received a paper proxy card and voting instructions by mail, by completing and returning the enclosed proxy card in the postage-prepaid envelope to ensure that your shares will be represented. Your vote by written proxy will ensure your representation at the Annual Meeting regardless of whether or not you attend virtually. Returning the proxy does not affect your right to attend the Annual Meeting and to vote your shares at the Annual Meeting.

Sincerely,

Sytse Sijbrandij

Co-Founder, Chair of the Board of Directors

and Chief Executive Officer

YOUR VOTE IS IMPORTANT

All stockholders are cordially invited to virtually attend the Annual Meeting. Whether or not you plan to attend the Annual Meeting, you are encouraged to submit your proxy and voting instructions via the Internet, or, if you received a paper proxy card and voting instructions by mail, you may vote your shares by completing, signing and dating the proxy card as promptly as possible and returning it in the enclosed envelope (to which no postage need be affixed if mailed in the United States). Even if you have given your proxy, you may still vote if you attend the Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must obtain from the record holder a proxy issued in your name. You may revoke a previously delivered proxy at any time prior to the Annual Meeting. You may do so automatically by voting at the Annual Meeting, or by delivering to us a written notice of revocation or a duly executed proxy bearing a date later than the date of the proxy being revoked.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON THURSDAY,TUESDAY, JUNE 29, 2023:11, 2024: THE PROXY STATEMENT AND ANNUAL REPORT ARE AVAILABLE AT HTTP://WWW.VIRTUALSHAREHOLDERMEETING.COM/GTLB2023GTLB2024. PROXY MATERIALS ARE ALSO AVAILABLE AT WWW.PROXYVOTE.COM.

GITLAB INC.

Address Not Applicable1

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Time and Date: Thursday,Tuesday, June 29, 202311, 2024 at 9:008:30 a.m. Pacific Time

May 15, 2023April 30, 2024

Place: Virtually at www.virtualshareholdermeeting.com/GTLB2023.GTLB2024. There is no physical location for the Annual Meeting.

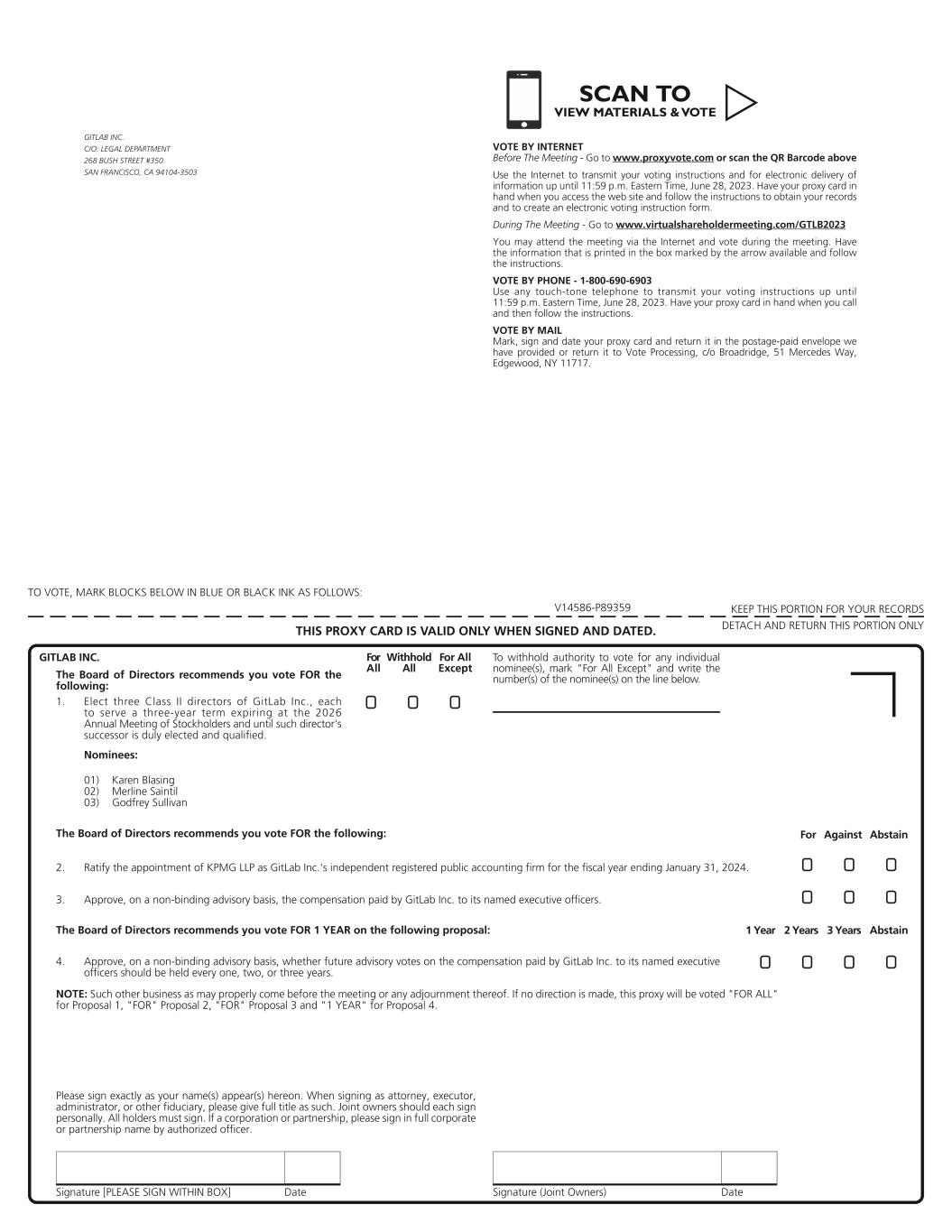

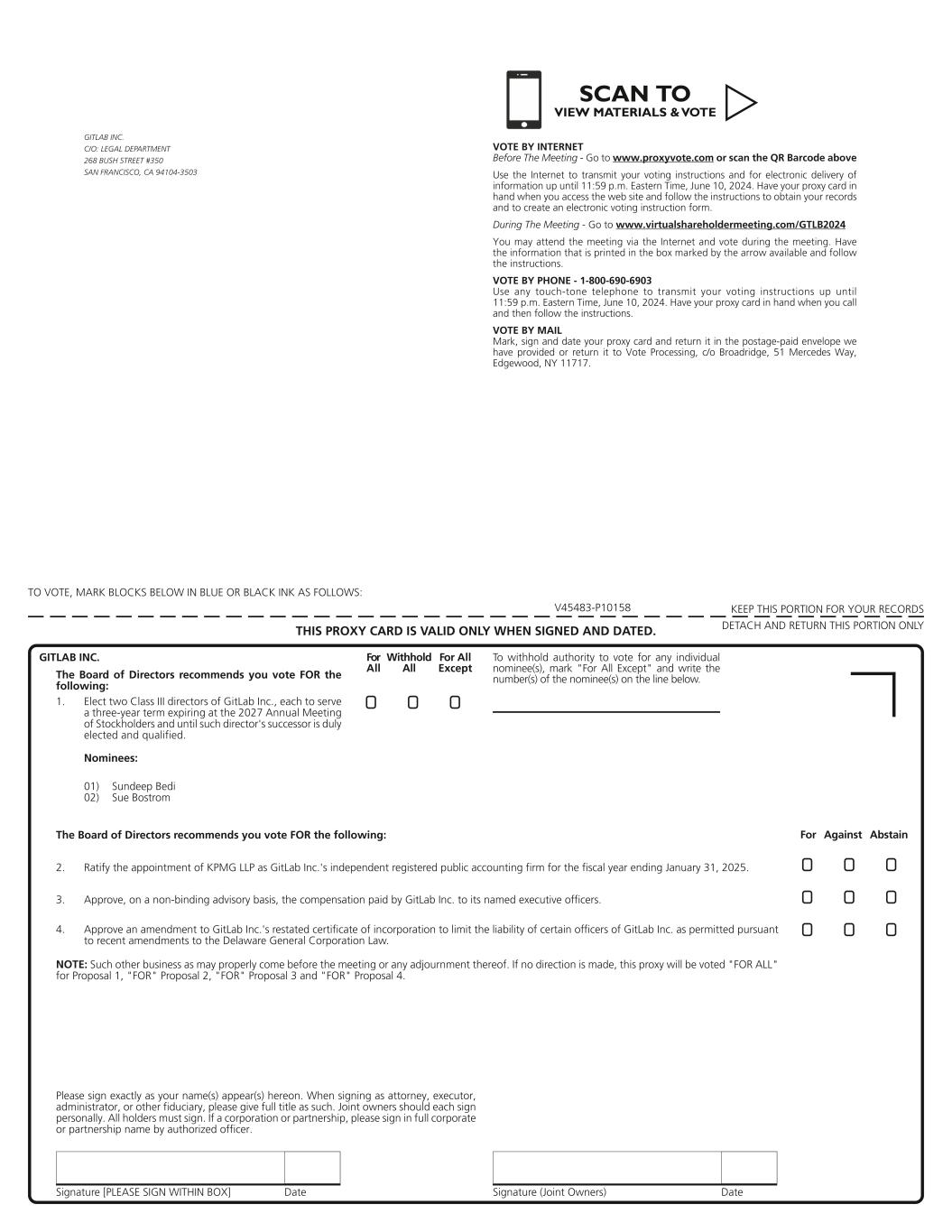

1.Elect threetwo Class IIIII directors of GitLab Inc., each to serve a three-year term expiring at the 20262027 annual meeting of stockholders and until such director is duly elected and qualified.

2.Ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending January 31, 2024.2025.

3.Approve, on a non-binding advisory basis, the compensation paid by GitLab Inc. to its named executive officers.

4.Approve on a non-binding advisory basis, whether future advisory votes onan amendment to GitLab Inc.’s Restated Certificate of Incorporation to limit the compensation paid by GitLab Inc.liability of certain officers of the company as permitted pursuant to its named executive officers should be held every one, two, or three years.recent amendments to the Delaware General Corporation Law (the “DGCL”).

5.Transact any other business as may properly come before the Annual Meeting or any adjournment or postponement of the

Annual Meeting.

Record Date: Only stockholders of record at the close of business on May 1, 2023April 15, 2024 are entitled to notice of, and to vote at, the meeting and any adjournments thereof.

Proxy Voting: Each share of Class A common stock that you own represents one vote and each share of Class B common stock that you own represents ten votes. For questions regarding your stock ownership, you may contact us through our website at https://ir.gitlab.com or, if you are a registered holder, our transfer agent, Computershare Trust Company, N.A., through its website at https://www-us.computershare.com/Investor/Company/ or by phone at 1-(800) 736-3001.

This Notice of the Annual Meeting, Proxy Statement, and form of proxy are being distributed and made available on or about May 15, 2023.April 30, 2024.

Whether or not you plan to attend the Annual Meeting, we encourage you to vote and submit your proxy through the Internet or by telephone or request and submit your proxy card as soon as possible, so that your shares may be represented at the meeting.

By Order of the Board of Directors,

Robin J. Schulman

Chief Legal Officer, Head of

Corporate Affairs, and

Corporate Secretary

San Francisco, California

May 15, 2023April 30, 2024

1We are a remote-only company. Accordingly, we do not maintain a headquarters. For purposes of compliance with applicable requirements of the Securities Act of 1933, as amended, and Securities Exchange Act of 1934, as amended, any stockholder communication required to be sent to our principal executive offices may be directed to the agent for service of process named above, or to the email address: reach.GitLab@GitLab.com.

GITLAB INC.

PROXY STATEMENT FOR 20232024 ANNUAL MEETING OF STOCKHOLDERS TABLE OF CONTENTS

| | Special Note Regarding Forward-Looking Statements | Special Note Regarding Forward-Looking Statements | | | Cash Annual Incentive Compensation | | Special Note Regarding Forward-Looking Statements | | | Cash Annual Incentive Compensation | |

| Proxy Statement Summary | Proxy Statement Summary | | | Long-Term Incentives | | Proxy Statement Summary | | | Long-Term Incentives | |

| Governance and Board Highlights | Governance and Board Highlights | | | Say on Pay Vote | | Governance and Board Highlights | | | Summary Compensation Table | |

| Independent Board and Leadership Practices | Independent Board and Leadership Practices | | | Summary Compensation Table | | Independent Board and Leadership Practices | | | Equity Compensation | |

| Corporate Responsibility | Corporate Responsibility | | | Equity Compensation | | Corporate Responsibility | | | Grants of Plan-Based Awards Table | |

| Information About Solicitation and Voting | Information About Solicitation and Voting | | | Grants of Plan-Based Awards Table | | Information About Solicitation and Voting | | | Outstanding Equity Awards at Fiscal Year-End Table | |

| Internet Availability of Proxy Materials | Internet Availability of Proxy Materials | | | Outstanding Equity Awards at Fiscal Year-End Table | | Internet Availability of Proxy Materials | | | 2024 Stock Option Exercises and Stock Vested Table | |

| General Information About the Meeting | General Information About the Meeting | | | 2023 Stock Options Exercises and Stock Vested Table | | General Information About the Meeting | | | Additional Compensation Practices and Policies | |

| Board of Directors and Committees of the Board of Directors; Corporate Governance Standards and Director Independence | Board of Directors and Committees of the Board of Directors; Corporate Governance Standards and Director Independence | | | Additional Compensation Practices and Policies | | Board of Directors and Committees of the Board of Directors; Corporate Governance Standards and Director Independence | | | Offer Letters and Employment Arrangements | |

| Nominations Process and Director Qualifications | Nominations Process and Director Qualifications | | | Offer Letters and Employment Arrangements | | Nominations Process and Director Qualifications | | | Potential Payments Upon Termination or Change of Control | |

| Proposal No. 1 Election of Directors | Proposal No. 1 Election of Directors | | | Potential Payments Upon Termination or Change in Control | | Proposal No. 1 Election of Directors | | | Tax and Accounting Treatment of Compensation | |

| Proposal No. 2 Ratification of Appointment of Independent Registered Public Accounting Firm | Proposal No. 2 Ratification of Appointment of Independent Registered Public Accounting Firm | | | Tax and Accounting Treatment of Compensation | | Proposal No. 2 Ratification of Appointment of Independent Registered Public Accounting Firm | | | CEO Pay Ratio | |

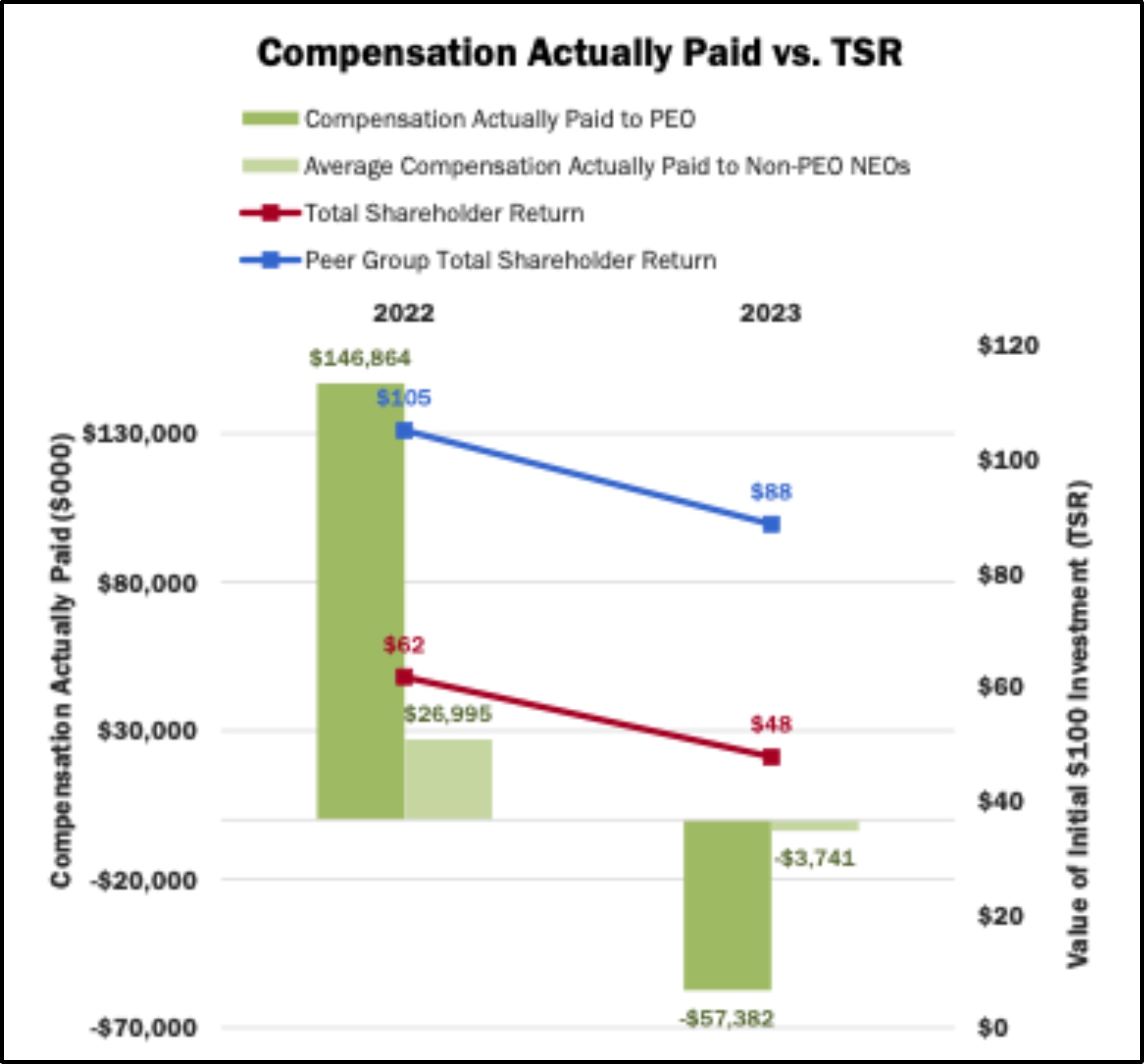

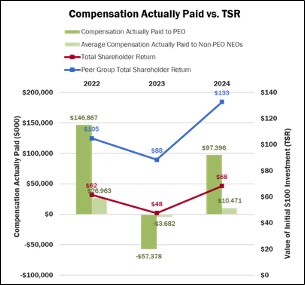

| Proposal No. 3 Advisory Vote on Named Executive Officer Compensation | Proposal No. 3 Advisory Vote on Named Executive Officer Compensation | | | Pay-Versus-Performance Disclosure | | Proposal No. 3 Advisory Vote on Named Executive Officer Compensation | | | Pay-Versus-Performance Disclosure | |

| Proposal No. 4 Advisory Vote on the Frequency of Future Advisory Votes on Named Executive Officer Compensation | | | Pay-Versus-Performance Table | |

| Proposal No. 4 Approval of Amendment to our Restated Certificate of Incorporation | | Proposal No. 4 Approval of Amendment to our Restated Certificate of Incorporation | | | Pay-Versus-Performance Table | |

| Report of the Audit Committee | Report of the Audit Committee | | | Report of the Compensation and Leadership Development Committee | | Report of the Audit Committee | | | Report of the Compensation and Leadership Development Committee | |

| Security Ownership of Certain Beneficial Owners and Management | Security Ownership of Certain Beneficial Owners and Management | | | Limitations on Liability and Indemnification Matters | | Security Ownership of Certain Beneficial Owners and Management | | | Limitations on Liability and Indemnification Matters | |

| Executive Officers | Executive Officers | | | Rule 10b5-1 Sales Plans | | Executive Officers | | | Rule 10b5-1 Sales Plans | |

| Executive Compensation | Executive Compensation | | | Equity Compensation Plan Information | | Executive Compensation | | | Equity Compensation Plan Information | |

| Compensation Discussion and Analysis | Compensation Discussion and Analysis | | | Certain Relationships and Related Party Transactions | | Compensation Discussion and Analysis | | | Certain Relationships and Related Party Transactions | |

| Executive Summary | Executive Summary | | | Additional Information | | Executive Summary | | | Additional Information | |

| Executive Compensation Program Design | Executive Compensation Program Design | | | Other Matters | | Executive Compensation Program Design | | | Other Matters | |

| Compensation Recovery Policy | | Compensation Recovery Policy | | | Appendix A - Certificate of Amendment of Restated Certificate of Incorporation | |

| Say on Pay Vote | | Say on Pay Vote | | | Appendix B - Reconciliation of Non-GAAP Measures | |

| Compensation Decision-Making Process | Compensation Decision-Making Process | | | Appendix A - Reconciliation of Non-GAAP Measures | | Compensation Decision-Making Process | | | Proxy Card | |

| Principal Elements of Compensation | Principal Elements of Compensation | | | Proxy Card | |

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Proxy Statement includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements contained in this Proxy Statement other than statements of historical fact, including statements regarding our future operating results and financial condition, our business strategy and plans, market growth, and our objectives for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “aim,” “may,” “will,” “should,“would,” “expect,” “believe,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential,” “seeks,” or “continue” or the negative of these terms or other similar expressions, although not all forward-looking statements contain these words.

These statements are not historical facts and are based on current expectations, estimates, and projections about our industry, management's beliefs, and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions, estimates, and uncertainties that are difficult to predict. For a discussion of some of the risks and important factors that could affect our future results and financial condition, see “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended January 31, 2023,2024, and our other Securities and Exchange Commission (“SEC”) filings, which are available on the Investor Relations page of our website at https://ir.gitlab.com and on the SEC website at www.sec.gov.

All forward-looking statements contained herein are based on information available to us as of the date hereof and you should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, performance, or achievements. We undertake no obligation to update any of these forward-looking statements for any reason after the date of this Proxy Statement or to conform these statements to actual results or revised expectations, except as required by law. Undue reliance should not be placed on forward-looking statements.

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. You should read the entire Proxy Statement before voting.

Meeting Agenda and Voting Recommendations

PROPOSAL NO. 1

ELECTION OF DIRECTORS

| | | | | |

We are asking our stockholders to elect threetwo Class IIIII directors for a three-year term expiring at the 20262027 annual meeting of stockholders and until such director’s successor is duly elected and qualified or until such director’s earlier death, resignation, disqualification or removal. The table below sets forth information with respect to our threetwo nominees standing for election. All of the nominees are currently serving as directors. Additional information about our director nominees and their respective qualifications can be found under the section titled “Proposal No. 1 Election of Directors—Nominees to Our Board of Directors.” | BOARD’S RECOMMENDATION “FOR ALL” nominees for this Proposal |

| | | | | | | | |

| Name | Age | Director Since |

Karen BlasingSundeep Bedi | 6750 | August 20192021 |

Merline SaintilSue Bostrom | 4663 | November 2020 |

Godfrey Sullivan | 69 | January 2020April 2019 |

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

| | | | | |

We are asking our stockholders to ratify the audit committee’s appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending January 31, 2024.2025. Information regarding fees paid to KPMG LLP during fiscal years 20232024 and 20222023 can be found under the section titled “Proposal No. 2 Ratification of Appointment of Independent Registered Public Accounting Firm—Independent Registered Public Accounting Firm Fees and ServicesServices..” | BOARD’S RECOMMENDATION “FOR” this Proposal |

PROPOSAL NO. 3

ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION

| | | | | |

We are asking our stockholders to approve, on a non-binding advisory basis, the compensation paid by us to our named executive officers. Information regarding compensation paid to our named executive officers can be found in the section titled “Executive Compensation.”

| BOARD’S RECOMMENDATION “FOR” this Proposal |

PROPOSAL NO. 4

ADVISORY VOTE ON THE FREQUENCYAPPROVAL OF FUTURE ADVISORY VOTES ON NAMED EXECUTIVE OFFICER COMPENSATIONAMENDMENT TO OUR RESTATED CERTIFICATE OF

INCORPORATION

| | | | | |

We are asking our stockholders to approve on a non-binding advisory basis, whether future advisory votes on the compensation paid by usproposed amendment to our named executiveRestated Certificate of Incorporation (the “Restated Certificate”) to limit the liability of certain officers should be held every one, two, or three years.of the company as permitted pursuant to recent amendments to the DGCL. Information regarding compensation paid to our named executive officersthe proposed amendment can be found in the section titled “Executive CompensationProposal No. 4 Approval of Amendment to our Restated Certificate of Incorporation.” | BOARD’S RECOMMENDATION “ONE YEAR” forFOR” this Proposal |

GOVERNANCE AND BOARD HIGHLIGHTS

We are committed to good corporate governance, which strengthens the accountability of our board of directors and promotes the long- term interests of our stockholders. The list below highlights our independent board and leadership practices, as discussed further in this Proxy Statement.

INDEPENDENT BOARD AND LEADERSHIP PRACTICES

•Majority of our directors are independent (seven(six out of eightseven current directors, other than our CEO/Chair)

•Board of directors leadership structure where a Lead Independent Director is elected annually and has well-defined rights and responsibilities, separate from the Chair

•All committees of the board of directors are composed of independent directors

•Board of directors is focused on continuing to enhance diversity and refreshment

•Comprehensive risk oversight practices, including cybersecurity, data privacy, legal and regulatory matters, and other critical evolving areas

•Our nominating and corporate governance committee oversees our programs relating to corporate responsibility and sustainability, including environmental, social, and corporate governance matters

•Independent directors conduct regular executive sessions

•Directors maintain open communication and strong working relationships among themselves and have regular access to management

•Directors conduct a robust annual board of directors and committee self-assessment process

•Board of directors has related party transaction standards for any direct or indirect involvement of a director in GitLab’s business activities

CORPORATE RESPONSIBILITY

We recognize the importance of a thoughtful approach to environmental, social, and governance (“ESG”) practices. Our ESG strategy is driven by our CREDIT values (i.e., Credit; Results; Collaboration; Results for Customers; Efficiency; Diversity, Inclusion & Belonging; Iteration; and Transparency), and as we continue to develop our strategies and practices in these areas, we are also committed to maintaining and improving our current programs. Specifically, the following outlines our progress and work in the areas of Environment, Social Impact, and Diversity, Inclusion & Belonging:

Environment

Environment:: We started purchasing carbon offsets in 2020 in our efforts to operate a sustainable business model and intend to conduct

In fiscal year 2024, we conducted our first formal greenhouse gas (“GHG”) inventory in 2023 to understand the full scope of our emissions. AsGitLab is a fully remote company without direct emissions from company-owned facilities or direct energy consumption. Accordingly, our GHG inventory measures Scope 3 emissions only, specifically the emissions associated with remote work, purchased goods and services, cloud services, and business travel. GitLab’s net corporate emissions for fiscal year 2023 were 16,654 metric tonnes of CO2e.

In January of 2024, GitLab purchased carbon removals for 8,580 tonnes of CO2e. The purchase funds reforestation programs around the world.

We will continue to use the results of the inventory to better understand our key sources of emissions, set reduction goals using measures from fiscal year 2023 as a baseline, develop a reduction plan, and educate our fully remote team on how they can understand and reduce their GHG emissions at home.

Additionally, in fiscal year 2024 we have compensated over 23,223 tonslaunched GitLab’s first scenario risk analysis to understand climate related risks and opportunities to the business. The results of CO2, which is the equivalent of planting over 13,126 trees or taking 5,049 passenger cars off the road for an entire year. In addition, the accredited carbon offsets we have purchased have avoided unplanned deforestation, improved forest management,this analysis and contributed to afforestation, reforestation and revegetationaccompanying Task Force on Climate-Related Financial Disclosures report will be included in a number of countries, including Peru, Colombia, and the United States.GitLab’s annual public ESG report.

Social ImpactImpact::

As part of our mission to create a world where everyone can contribute, we believe it is important to support organizations that can further this goal at both local and global levels. We have worked to further this mission in two key areas. First, ourwe launched GitLab for Education Program providesNonprofits, a program to provide in-kind products to nonprofit organizations. This program joins existing community programs that serve open source programs, educational institutes and startups and seeks to expand the top tiers ofimpact GitLab, for free to students, teachers, and faculty at educational institutions around the globe for teaching, learning, and research. To be eligible, educational institutions must satisfy certain requirements, such as being a qualified educational institution, and the GitLab educational licenseproduct, can only be used for purposes of instructional use or non-commercial academic research. As of January 2023, GitLab’s top tier hosts over 3 million users through the GitLab for Education Program, from over 1,000 educational institutions in over 65 countries. Our GitLab for Education Program ties into our stated purpose of helping people increase their lifetime earnings through training, access to opportunities and our DevSecOps Platform.have on organizations. Second, GitLab is dedicated to supporting charitable organizations with missions that align with our company’s values. For example, in September 2021, our board of directors approved the reservation of up to 1,635,545 shares of our Class A common stock for issuance to charitable organizations, to be further designated by the board of directors. In March 2023, ourOur board of directors giftedhave approved an aggregate of 324,144$10,700,000 (in fiscal year 2024) and $11,826,865 (in fiscal year 2025) in shares of our Class A common stock to be donated in fiscal year 2024 and fiscal year 2025, respectively, to the GitLab Foundation. The GitLab Foundation is a global nonprofit organization associated with GitLab whichand seeks to improve individuals’ financial security through access to education, training and other opportunities.

Diversity, Inclusion & BelongingBelonging::

Diversity, Inclusion & Belonging is fundamental to the success of GitLab and is one of our core values. We include it in every way possibleAs a core value we work to ensure Diversity, Inclusion and Belonging is incorporated and considered in all that we do. We strive for a transparent environment where all globally dispersed voices are heard and welcomed and where people can show up as their full selves each day and can contribute to their best ability. With global organizations utilizing GitLab, we strive for a team that is representative of our users.

GitLab has 1110 Team Member Resource Groups (“TMRGs”). TMRGs are voluntary, team member-led groups focused on fostering diversity, inclusion and belonging within GitLab. These groups help team members build stronger internal and external connections; offer social, educational, and outreach activities; create development opportunities for future leaders; and increase engagement among team members.

We're a team of helpful, passionate people who want to see each other, GitLab, and the broader GitLab community succeed. We care about what our team members achieve: the code shipped, the user that was made happy, and the team member that was helped. Our entire workforce is remote, allowing people of all backgrounds and abilities to join our team. As GitLab has grown, we’ve learned a lot about what it takes to build and manage a fully remote team and we share what we learn with anyone in the world with our Guide to All Remote.

Building a diverse and inclusive open source community takes time, effort, intentionality, and persistence. And it’s an investment we are committed to continue both externally and for our team members, together, one year at a time.

GITLAB INC.

Address Not Applicable

PROXY STATEMENT FOR THE

20232024 ANNUAL MEETING OF STOCKHOLDERS

May 15, 2023April 30, 2024

INFORMATION ABOUT SOLICITATION AND VOTING

The accompanying proxy is solicited on behalf of the board of directors of GitLab Inc. for use at our 20232024 Annual Meeting of Stockholders (the “Annual Meeting”) to be held virtually at www.virtualshareholdermeeting.com/GTLB2023GTLB2024. Stockholders may log in 15 minutes prior to the meeting on Thursday,Tuesday, June 29, 202311, 2024 at 9:008:30 a.m. Pacific Time, and any adjournment or postponement thereof. The Notice of Internet Availability of Proxy Materials and this proxy statement for the Annual Meeting (the “Proxy Statement”) and the accompanying form of proxy were first distributed and made available on the Internet to stockholders on or about May 15, 2023.April 30, 2024. An annual report to stockholders for the fiscal year ended January 31, 20232024 is available with this Proxy Statement by following the instructions in the Notice of Internet Availability of Proxy Materials. In this Proxy Statement, we refer to GitLab Inc. as “GitLab,” “we,” “our,” or “us.” References to our website in this Proxy Statement are not intended to function as hyperlinks and the information contained on our website is not intended to be incorporated into this Proxy Statement.

INTERNET AVAILABILITY OF PROXY MATERIALS

In accordance with SEC rules, we are using the Internet as our primary means of furnishing proxy materials to stockholders. Consequently, most stockholders will not receive paper copies of our proxy materials. We will instead send these stockholders a Notice of Internet Availability of Proxy Materials with instructions for accessing the proxy materials, including our Proxy Statement and annual report, and voting via the Internet. The Notice of Internet Availability of Proxy Materials also provides information on how stockholders may obtain paper copies of our proxy materials if they so choose. We believe this rule makes the proxy distribution process more efficient, less costly, and helps in conserving natural resources.

GENERAL INFORMATION ABOUT THE MEETING

Purpose of the Annual Meeting

You are receiving this Proxy Statement because our board of directors is soliciting your proxy to vote your shares at the Annual Meeting with respect to the proposals described in this Proxy Statement. This Proxy Statement includes information that we are required to provide to you pursuant to the rules and regulations of the SEC and is designed to assist you in voting your shares.

We intend to ensure that our stockholders are afforded the same rights and opportunities to participate virtually as they would at an in-person meeting. We believe the virtual format makes it easier for stockholders to attend, and participate fully and equally in, the Annual Meeting because they can join with any internet-connected device from any location around the world at no cost. Our virtual meeting format not only aligns with our all remote culture, it also helps us engage with all stockholders — regardless of size, resources, or physical location, saves us and stockholders’ time and money, and reduces our environmental impact.

Record Date; Quorum

Only holders of record of our Class A common stock and Class B common stock at the close of business on May 1, 2023April 15, 2024 (the “Record Date”) will be entitled to vote at the Annual Meeting. At the close of business on the Record Date, we had 96,235,127132,547,710 shares of Class A common stock and 56,721,39326,365,064 shares of Class B common stock outstanding and entitled to vote. At the close of business on the Record Date, our directors and executive officers and their respective affiliates beneficially owned and were entitled to vote 8,761,188 shares of Class A common stock and 30,314,918 shares of Class B common stock at the Annual Meeting, or approximately 25.554% of the voting power of the shares of our Class A common stock and Class B common stock outstanding on such date. For ten days prior to the Annual Meeting, a complete list of the stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder for any purpose relating to the Annual Meeting during ordinary business hours at our website: www.virtualshareholdermeeting.com/GTLB2023GTLB2024.

The holders of a majority of the voting power of the shares of our Class A common stock and Class B common stock (voting together as a single class) entitled to vote at the Annual Meeting as of the Record Date must be present at the Annual Meeting in order to hold the Annual Meeting and conduct business. This presence is called a quorum. Your shares are counted as present at the Annual Meeting if you are present and vote at the Annual Meeting or if you have properly submitted a proxy.

Participating in the Annual Meeting

•Instructions on how to attend the Annual Meeting are posted at www.virtualshareholdermeeting.com/GTLB2023GTLB2024.

•You may log in to the meeting platform beginning at 8:4515 a.m. Pacific Time on June 29, 2023.11, 2024. The meeting will begin promptly at 9:008:30 a.m. Pacific Time.

•You will need the 16-digit control number provided in your proxy materials to attend the Annual Meeting at www.virtualshareholdermeeting.com/GTLB2023GTLB2024.

•Stockholders of record and beneficial owners as of the Record Date may vote their shares electronically during the Annual Meeting.

•If you wish to submit a question during the Annual Meeting, log into the virtual meeting platform at www.virtualshareholdermeeting.com/GTLB2023GTLB2024, type your question into the “Ask a Question” field, and click “Submit.” If your question is properly submitted during the relevant portion of the meeting agenda, we will respond to your question during the live webcast, subject to time constraints. Questions that are substantially similar may be grouped and answered together to avoid repetition. We reserve the right to exclude questions that are irrelevant to meeting matters, irrelevant to the business of GitLab, or derogatory or in bad taste; that relate to pending or threatened litigation; that are personal grievances; or that are otherwise inappropriate (as determined by the chair of the Annual Meeting). A webcast replay of the Annual Meeting, including the Q&A session, will be archived on the “Investor Relations” section of our website, which is located at ir.gitlab.com.

•If we experience technical difficulties during the meeting (e.g., a temporary or prolonged power outage), we will determine whether the meeting can be promptly reconvened (if the technical difficulty is temporary) or whether the meeting will need to be reconvened on a later day (if the technical difficulty is more prolonged). In any situation, we will promptly notify stockholders of the decision via www.virtualshareholdermeeting.com/GTLB2023GTLB2024. If you encounter technical difficulties accessing our meeting or asking questions during the meeting, a support line will be available on the login page of the virtual meeting website.

Voting Rights; Required Vote

In deciding all matters at the Annual Meeting, as of the close of business on the Record Date, each share of Class A common stock represents one vote and each share of Class B common stock represents ten votes. We do not have cumulative voting rights for the election of directors. You may vote all shares owned by you as of the Record Date, including (i) shares held directly in your name as the stockholder of record and (ii) shares held for you as the beneficial owner in street name through a broker, bank, trustee, or other nominee.

Stockholder of Record: Shares Registered in Your Name. If, on the Record Date, your shares were registered directly in your name with our transfer agent, Computershare Trust Company, N.A., then you are considered the stockholder of record with respect to those shares. As a stockholder of record, you may vote at the Annual Meeting or vote by telephone, through the Internet or, if you request or receive paper proxy materials, by filling out and returning the proxy card.

Beneficial Owner: Shares Registered in the Name of a Broker or Nominee. If, on the Record Date, your shares were held in an account with a brokerage firm, bank or other nominee, then you are the beneficial owner of the shares held in street name. As a beneficial owner, you have the right to direct your nominee on how to vote the shares held in your account, and your nominee has enclosed or provided voting instructions for you to use in directing it on how to vote your shares. However, the organization that holds your shares is considered the stockholder of record for purposes of voting at the Annual Meeting. Because you are not the stockholder of record, you may not vote your shares at the Annual Meeting unless you request and obtain a valid proxy from the organization that holds your shares giving you the right to vote the shares at the Annual Meeting.

Each director will be elected by a plurality of the votes cast, which means that the threetwo individuals nominated for election to our board of directors at the Annual Meeting receiving the highest number of “FOR” votes will be elected. You may vote “FOR ALL NOMINEES,” “WITHHOLD AUTHORITY FOR ALL NOMINEES” or vote “FOR ALL EXCEPT” one or any of the nominees you specify. Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending January 31, 20242025 will be obtained if the number of votes cast “FOR” the proposal at the Annual Meeting exceeds the number of votes “AGAINST” the proposal. Approval, on a non-binding advisory basis, of the compensation of our named executive officers will be obtained if the number of votes cast “FOR” the proposal at the Annual Meeting exceeds the number of votes “AGAINST” the proposal. Stockholders have four options with respectThe proposal to the non-binding advisory vote on the frequencyamend our Restated Certificate will be approved if holders of future advisory votes on the compensationa majority of our named executive officers. outstanding shares of Class A common stock and Class B common stock, voting as a single class, vote “FOR” the proposal at the Annual Meeting. You may vote “FOR” or “AGAINST” or “ABSTAIN” from voting for holding the non-binding advisory vote to approve the compensation of our named executive officers every “ONE YEAR,” “TWO YEARS,” or “THREE YEARS,” or vote for “ABSTAIN.” The frequency receiving the greatest number of votes cast by stockholders at the Annual Meeting will be deemed to be the preferred frequency option of our stockholders.Proposal Nos. 2, 3 and 4.

Recommendations of Our Board of Directors on Each of the Proposals Scheduled to be Voted on at the Annual Meeting

Our board of directors recommends that you vote “FOR ALL NOMINEES” of the Class IIIII directors named in this Proxy Statement, (“Proposal No. 1”), “FOR” the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending January 31, 20242025 (“Proposal No. 2”), “FOR” the compensation paid by us to our named executive officers (“Proposal No. 3”), and every “ONE YEAR” for future advisory votes on“FOR” the compensation paid by usproposal to amend our named executive officersRestated Certificate (“Proposal No. 4”). None of our directors or executive officers has any substantial interest in any matter to be acted upon, other than Proposal No. 1, Proposal No. 3, and Proposal No. 4.

Abstentions; Withholding; Broker Non-Votes

Under Delaware law, abstentions (shares present at the Annual Meeting and marked “abstain”) are counted as present and entitled to vote for purposes of determining whether a quorum is present. At the Annual Meeting, abstentions and proxies marked “withhold authority” will have no effect on Proposal No. 1, Proposal No. 2 or Proposal No. 3 orand will have the same effect as a vote “AGAINST” Proposal No. 4.

Broker non-votes occur when shares held by a broker for a beneficial owner are not voted either because (i) the broker did not receive voting instructions from the beneficial owner, or (ii) the broker lacked discretionary authority to vote the shares. A broker is entitled to vote shares held for a beneficial owner on “routine” matters without instructions from the beneficial owner of those shares. Absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on “non- routine” matters. At our Annual Meeting, only the ratification of KPMG LLP as our independent registered public accounting firm for the fiscal year ending January 31, 2024,2025, is considered a routine matter. If a broker chooses not to vote shares for or against Proposal No. 2, it would have the same effect as an abstention. The other proposals presented at the Annual Meeting are non-routine matters. Broker non-votes are counted for purposes of determining whether a quorum is present, and have no effect on the outcome of Proposal No. 1 and Proposal No. 3 and will have the matters voted upon.same effect as a vote “AGAINST” Proposal No. 4. Accordingly, we encourage you to provide voting instructions to your broker, whether or not you plan to attend the Annual Meeting.

Voting Instructions; Voting of Proxies

| | | | | | | | |

| Vote By Internet | Vote By Telephone or Internet | Vote By Mail |

You may vote prior to the day of the meeting, voting is available at www.proxyvote.com or via the virtual meeting website—any stockholder can attend the Annual Meeting by visiting www.virtualshareholdermeeting.com/GTLB2023GTLB2024, where stockholders may vote and submit questions during the meeting. The meeting starts at 9:008:30 a.m. Pacific Time. Please have your 16- Digit Control Number to join the Annual Meeting. Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/GTLB2023GTLB2024. | You may vote prior to the meeting by telephone by calling 800-690-6903 or through the Internet at www.proxyvote.com in order to do so, please follow the instructions shown on your proxy card. Votes are accepted up until 8:59 p.m. Pacific Time or 11:59 p.m. Eastern Time on June 28, 2023.10, 2024. | You may vote by mail—if you request or receive a paper proxy card and voting instructions by mail, simply complete, sign and date the enclosed proxy card and promptly return it in the envelope provided or, if the envelope is missing, please mail your completed proxy card to Vote Processing, c/o Broadridge Financial Solutions, Inc., 51 Mercedes Way, Edgewood, New York 11717. Your completed, signed, and dated proxy card must be received prior to the Annual Meeting. |

Votes submitted by telephone or through the Internet must be received by 11:59 p.m. Eastern Time on June 28, 2023.10, 2024. Submitting your proxy, whether by telephone, through the Internet or, if you request or receive a paper proxy card, by mail will not affect your right to vote in person should you decide to attend the Annual Meeting. If you are not the stockholder of record, please refer to the voting instructions provided by your nominee to direct your nominee on how to vote your shares. Your vote is important. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure that your vote is counted. Your vote is important. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure that your vote is counted.

All proxies will be voted in accordance with the instructions specified on the proxy card. If you sign a physical proxy card and return it without instructions as to how your shares should be voted on a particular proposal at the Annual Meeting, your shares will be voted in accordance with the recommendations of our board of directors stated above.

If you do not vote and you hold your shares in street name, and your broker does not have discretionary power to vote your shares, your shares may constitute “broker non-votes” (as described above) and will not be counted in determining the number of shares necessary for approval of the proposals. However, broker non-votes will be counted for the purpose of establishing a quorum for the Annual Meeting.

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. To make certain all of your shares are voted, please follow the instructions included on each proxy card and vote each proxy card by telephone, through the Internet or by mail. If you requested or received paper proxy materials and you intend to vote by mail, please complete, sign and return each proxy card you received to ensure that all of your shares are voted.

We strongly recommend that you vote your shares in advance of the meeting as instructed above, even if you plan to attend the Annual Meeting virtually.

Expenses of Soliciting Proxies

We will pay the expenses of soliciting proxies, including preparation, assembly, printing and mailing of this Proxy Statement, the proxy and any other information furnished to stockholders. Following the original mailing of the soliciting materials, we and our agents, including directors, officers, and other team members, without additional compensation, may solicit proxies by mail, email, telephone, facsimile, by other similar means or in person. Following the original mailing of the soliciting materials, we will request brokers, custodians, nominees and other record holders to forward copies of the soliciting materials to persons for whom they hold shares and to request authority for the exercise of proxies. In such cases, we, upon the request of the record holders, will reimburse such holders for their reasonable expenses. If you choose to access the proxy materials or vote through the Internet, you are responsible for any Internet access charges you may incur.

Revocability of Proxies

A stockholder of record who has given a proxy may revoke it at any time before it is exercised at the Annual Meeting by:

•delivering to our Corporate Secretary by mail a written notice stating that the proxy is revoked;

•signing and delivering a proxy bearing a later date;

•voting again through the Internet; or

•attending and voting at the Annual Meeting (although attendance at the Annual Meeting will not, by itself, revoke a proxy).

Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to revoke a proxy, you must contact that firm to revoke any prior voting instructions.

Voting Results

Voting results will be tabulated and certified by the inspector of elections appointed for the Annual Meeting. The preliminary voting results will be announced at the Annual Meeting. The final results will be tallied by the inspector of elections and filed with the SEC in a current report on Form 8-K within four business days of the Annual Meeting.

BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD OF DIRECTORS; CORPORATE GOVERNANCE STANDARDS AND DIRECTOR INDEPENDENCE

We are strongly committed to good corporate governance practices. These practices provide an important framework within which our board of directors and management can pursue our strategic objectives for the benefit of our stockholders.

Corporate Governance Guidelines

Our board of directors has adopted Corporate Governance Guidelines that set forth expectations for directors, director independence standards, board committee structure and functions, and other policies for the governance of GitLab. Our Corporate Governance Guidelines are available without charge on the “Investors” section of our website, which is located at https://ir.gitlab.com, by clicking “Documents & Charters” in the “Governance” section of our website. Our nominating and corporate governance committee reviews the Corporate Governance Guidelines periodically, and changes are recommended to our board of directors as warranted.

Board Leadership Structure

Our Corporate Governance Guidelines provide that our board of directors shall be free to choose its chair in any way that it considers to be in the best interests of our company, and that the nominating and corporate governance committee periodically considers the leadership structure of our board of directors and makes such recommendations to our board of directors with respect thereto as appropriate. Our Corporate Governance Guidelines also provide that, when the positions of chair and chief executive officer are held by the same person, our board of directors shall designate a “lead independent director” by a majority vote of the independent directors. In cases in which the chair and chief executive officer are the same person, the chair schedules and sets the agenda for meetings of our board of directors in consultation with the lead independent director, and the chair, or if the chair is not present, the lead independent director, chairs such meetings. The responsibilities of the lead independent director include: presiding at executive sessions of independent directors, serving as a liaison between the chair and the independent directors, consulting with the chair regarding the information sent to our board of directors in connection with its meetings, having the authority to call meetings of the independent directors, being available under appropriate circumstances for consultation and direct communication with stockholders, and performing such other functions and responsibilities as requested by our board of directors from time to time.

Currently, our board of directors believes that it should maintain flexibility to select the chair of our board of directors and adjust our board leadership structure from time to time. Mr. Sijbrandij, our Chief Executive Officer (“CEO”), is also the Chair of our board of directors. Our board of directors determined that having our CEO also serve as the Chair of our board of directors provides us with optimally effective leadership and is in our best interests and those of our stockholders. Mr. Sijbrandij co-founded and has led our company since 2012. Our board of directors believes that Mr. Sijbrandij’s strategic vision for our business, his in-depth knowledge of our platform and operations and the software technology industry, and his experience serving as the Chair of our board of directors and CEO since our inception make him well qualified to serve as both Chair of our board of directors and CEO.

Because Mr. Sijbrandij serves in both these roles, our board of directors appointed Godfrey Sullivan to serve as our lead independent director. As lead independent director, Mr. Sullivan presides over periodic meetings of our independent directors, serves as a liaison between the chair of our board of directors and the independent directors, and performs such additional duties as our board of directors may otherwise determine and delegate. Our board of directors believes that its independence and oversight of management is maintained effectively through this leadership structure, the composition of our board of directors and sound corporate governance policies and practices.

Our Board of Directors’ Role in Risk Oversight

Our board of directors, as a whole, has responsibility for risk oversight, although the committees of our board of directors oversee and review risk areas that are particularly relevant to them. The risk oversight responsibility of our board of directors and its committees is supported by our management reporting processes, which are designed to provide visibility to our board of directors and to our personnel that are responsible for risk assessment and information about the identification, assessment and management of critical risks and management’s risk mitigation strategies. These areas of focus include competitive, economic, operational, financial (accounting, credit, investment, liquidity and tax), legal, regulatory, cybersecurity, privacy, compliance and reputational risks. Our board of directors reviews strategic and operational risk in the context of discussions, question and answer sessions, and reports from the management team at each regular board meeting, receives reports on all significant committee activities at each regular board meeting, and evaluates the risks inherent in significant transactions. Our audit committee assists our board of directors in fulfilling its oversight responsibilities with respect to risk management.

Each committee of our board of directors meets with key management personnel and representatives of outside advisors to oversee risks associated with their respective principal areas of focus. Our audit committee reviews our major financial risk exposures, our internal control over financial reporting, our disclosure controls and procedures, legal and regulatory compliance, and, among other things, discusses with management and our independent auditor guidelines and policies with respect to risk assessment and risk management. Our audit committee also reviews matters relating to cybersecurity and data privacy and security and reports to our board of directors regarding such matters. Our compensation and leadership development committee evaluates our major compensation related risk exposures and the steps management has taken to monitor or mitigate such exposures. Our nominating and corporate governance committee assesses risks relating to our corporate governance practices, the independence of our board of directors and reviews and discusses the narrative disclosure regarding our board of directors’ leadership structure and role in risk oversight. We believe this division of responsibilities is an effective approach for addressing the risks we face and that our board leadership structure supports this approach.

Independence of Directors

The listing rules of the Nasdaq Stock Market LLC (“Nasdaq”), generally require that independent directors constitute a majority of a listed company’s board of directors. In addition, the Nasdaq rules require that, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating and corporate governance committees must be an “independent director.” Under the rules of Nasdaq, a director will only qualify as an “independent director” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Additionally, compensation committee members must not have a relationship with the listed company that is material to the director’s ability to be independent from management in connection with the duties of a compensation committee member.

In addition, audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors, or any other board committee: accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries; or be an affiliated person of the listed company or any of its subsidiaries.

Our board of directors has undertaken a review of the independence of each director and considered whether each director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. As a result of this review, our board of directors determined that each of our directors other than Mr. Sijbrandij are “independent directors” as defined under the applicable rules and regulations of the SEC and the listing requirements and rules of Nasdaq. In making these determinations, our board of directors reviewed and discussed information provided by the directors and by us with regard to each director’s business and personal activities and relationships as they may relate to us and our management, including the beneficial ownership of our common stock by each non-employee director and the transactions involving them described in the section titled “Certain Relationships and Related Party Transactions.”

Committees of Our Board of Directors

Our board of directors has established an audit committee, a compensation and leadership development committee, and a nominating and corporate governance committee. The composition and responsibilities of each committee are described below. Each of these committees has a written charter approved by our board of directors. Copies of the charters for each committee are available, without charge, in the “Investor Relations” section of our website, which is located at https://ir.gitlab.com, by clicking on “Documents & Charters” in the “Governance” section of our website. Members serve on these committees until their resignations or until otherwise determined by our board of directors.

Audit Committee

Our audit committee is composed of Karen Blasing, Sundeep Bedi, and Mark Porter.Godfrey Sullivan. Ms. Blasing is the chair of our audit committee. The members of our audit committee meet the independence requirements under Nasdaq and SEC rules and regulations. Each member of our audit committee is financially literate. In addition, our board of directors has determined that Ms. Blasing is an “audit committee financial expert” as that term is defined in Item 407(d)(5)(ii) of Regulation S-K promulgated under the Securities Act of 1933, as amended (the “Securities Act”). This designation does not impose any duties, obligations or liabilities that are greater than those generally imposed on other members of our audit committee and our board of directors. Our audit committee is responsible for, among other things, assisting our board of directors in its oversight of:

•selecting a firm to serve as our independent registered public accounting firm to audit our financial statements;

•ensuring the independence of the independent registered public accounting firm;

•discussing the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and the independent registered public accounting firm, our interim and year-end operating results;

•establishing procedures for team members to anonymously submit concerns about questionable accounting or audit matters;

•considering the adequacy of our internal controls and internal audit function;

•reviewing the Company’s cybersecurity and other information technology risks, controls and procedures;

•reviewing related party transactions that are material or otherwise implicate disclosure requirements; and

•approving or, as permitted, pre-approving all audit and non-audit services to be performed by the independent registered public accounting firm.

Our audit committee during the fiscal year ended January 31, 20232024 also included David Hornik and Godfrey Sullivan.Mark Porter. Mr. HornikPorter resigned from our board of directors and the audit committee in March 2022. Mr. Porter replaced Mr. Godfrey on our audit committee in December 2022 in connection with Mr. Porter’s appointment to the board of directors.effective April 12, 2024.

Compensation and Leadership Development Committee

Our compensation and leadership development committee is composed of Sue Bostrom, Matthew Jacobson, and Merline Saintil. Ms. Bostrom is the chair of our compensation and leadership development committee. The members of our compensation and leadership development committee meet the independence requirements under Nasdaq and SEC rules and regulations. Each member of the compensation and leadership development committee is also a “non-employee director” within the meaning of Rule 16b-3 under the Exchange Act. Our compensation and leadership development committee is responsible for, among other things:

•reviewing and approving, or recommending that our board of directors approve, the compensation of our executive officers;

•reviewing and recommending to our board of directors the compensation of our non-employee directors;

•reviewing and recommending to our board of directors the terms of any compensatory agreements with our executive officers;

•administering our stock and equity incentive plans;

•reviewing and approving, or making recommendations to our board of directors with respect to, incentive compensation and equity plans; and

•establishing our overall compensation philosophy.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee is composed of Matthew Jacobson, Sue Bostrom, and Godfrey Sullivan. Mr. Jacobson is the chair of our nominating and corporate governance committee. The members of our nominating and corporate governance committee meet the independence requirements under Nasdaq and SEC rules and regulations. Our nominating and corporate governance committee is responsible for, among other things:

•identifying and recommending candidates for membership on our board of directors;

•recommending directors to serve on board committees;

•reviewing and recommending to our board of directors any changes to our corporate governance guidelines;

•reviewing proposed waivers of the code of conduct for directors and executive officers;

•overseeing the process of evaluating the performance of our board of directors; and

•advising our board of directors on corporate governance matters.

Compensation and Leadership Development Committee Interlocks and Insider Participation

The members of our compensation and leadership development committee during the fiscal year ended January 31, 20232024 included Ms. Bostrom, Mr. Jacobson and Ms. Saintil. None of the members of the compensation and leadership development committee in fiscal year 20232024 was at any time during fiscal year 20232024 or at any other time an officer or team member of ours or any of our subsidiaries, and none had or have any relationships with us that are required to be disclosed under Item 404 of Regulation S-K. During fiscal year 2023,2024, none of our executive officers served as a member of our board of directors, or as a member of the compensation or similar committee, of any entity that has one or more executive officers who served on our board of directors or compensation and leadership development committee.

Anti-HedgingELECTION OF DIRECTORS

| | | | | |

We are asking our stockholders to elect two Class III directors for a three-year term expiring at the 2027 annual meeting of stockholders and until such director’s successor is duly elected and qualified or until such director’s earlier death, resignation, disqualification or removal. The table below sets forth information with respect to our two nominees standing for election. All of the nominees are currently serving as directors. Additional information about our director nominees and their respective qualifications can be found under the section titled “Proposal No. 1 Election of Directors—Nominees to Our Board of Directors.” | BOARD’S RECOMMENDATION “FOR ALL” nominees for this Proposal |

| | | | | | | | |

| Name | Age | Director Since |

| Sundeep Bedi | 50 | August 2021 |

| Sue Bostrom | 63 | April 2019 |

See

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

| | | | | |

We are asking our stockholders to ratify the audit committee’s appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending January 31, 2025. Information regarding fees paid to KPMG LLP during fiscal years 2024 and 2023 can be found under the section titled “Proposal No. 2 Ratification of Appointment of Independent Registered Public Accounting Firm—Independent Registered Public Accounting Firm Fees and Services.” | BOARD’S RECOMMENDATION “FOR” this Proposal |

PROPOSAL NO. 3

ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION

| | | | | |

We are asking our stockholders to approve, on a non-binding advisory basis, the compensation paid by us to our named executive officers. Information regarding compensation paid to our named executive officers can be found in the section titled “Executive Compensation.”

| BOARD’S RECOMMENDATION “FOR” this Proposal |

PROPOSAL NO. 4

APPROVAL OF AMENDMENT TO OUR RESTATED CERTIFICATE OF

INCORPORATION

| | | | | |

We are asking our stockholders to approve the proposed amendment to our Restated Certificate of Incorporation (the “Restated Certificate”) to limit the liability of certain officers of the company as permitted pursuant to recent amendments to the DGCL. Information regarding the proposed amendment can be found in the section titled “Proposal No. 4 Approval of Amendment to our Restated Certificate of Incorporation.” | BOARD’S RECOMMENDATION “FOR” this Proposal |

GOVERNANCE AND BOARD HIGHLIGHTS

We are committed to good corporate governance, which strengthens the section entitled “accountability of our board of directors and promotes the long- term interests of our stockholders. The list below highlights our independent board and leadership practices, as discussed further in this Proxy Statement.

INDEPENDENT BOARD AND LEADERSHIP PRACTICES

•Additional Compensation PracticesMajority of our directors are independent (six out of seven current directors, other than our CEO/Chair)

•Board of directors leadership structure where a Lead Independent Director is elected annually and Policies—Anti-hedging Policyhas well-defined rights and responsibilities, separate from the Chair

•”All committees of the board of directors are composed of independent directors

•Board of directors is focused on continuing to enhance diversity and refreshment

•Comprehensive risk oversight practices, including cybersecurity, data privacy, legal and regulatory matters, and other critical evolving areas

•Our nominating and corporate governance committee oversees our programs relating to corporate responsibility and sustainability, including environmental, social, and corporate governance matters

•Independent directors conduct regular executive sessions

•Directors maintain open communication and strong working relationships among themselves and have regular access to management

•Directors conduct a robust annual board of directors and committee self-assessment process

•Board of directors has related party transaction standards for information regardingany direct or indirect involvement of a director in GitLab’s business activities

CORPORATE RESPONSIBILITY

We recognize the importance of a thoughtful approach to environmental, social, and governance (“ESG”) practices. Our ESG strategy is driven by our anti-hedging policyCREDIT values (i.e. Collaboration; Results for Customers; Efficiency; Diversity, Inclusion & Belonging; Iteration; and Transparency), and as we continue to develop our strategies and practices in these areas, we are also committed to maintaining and improving our current programs. Specifically, the following outlines our progress and work in the areas of Environment, Social Impact, and Diversity, Inclusion & Belonging:

Environment:

In fiscal year 2024, we conducted our first greenhouse gas (“GHG”) inventory to understand the full scope of our emissions. GitLab is a fully remote company without direct emissions from company-owned facilities or direct energy consumption. Accordingly, our GHG inventory measures Scope 3 emissions only, specifically the emissions associated with remote work, purchased goods and services, cloud services, and business travel. GitLab’s net corporate emissions for fiscal year 2023 were 16,654 metric tonnes of CO2e.

In January of 2024, GitLab purchased carbon removals for 8,580 tonnes of CO2e. The purchase funds reforestation programs around the world.

We will continue to use the results of the inventory to better understand our key sources of emissions, set reduction goals using measures from fiscal year 2023 as a baseline, develop a reduction plan, and educate our fully remote team on how they can understand and reduce their GHG emissions at home.

Additionally, in fiscal year 2024 we launched GitLab’s first scenario risk analysis to understand climate related risks and opportunities to the business. The results of this analysis and accompanying Task Force on Climate-Related Financial Disclosures report will be included in our Insider Trading Policy.GitLab’s annual public ESG report.

Social Impact:

As part of our mission to create a world where everyone can contribute, we believe it is important to support organizations that can further this goal at both local and global levels. We have worked to further this mission in two key areas. First, we launched GitLab for Nonprofits, a program to provide in-kind products to nonprofit organizations. This program joins existing community programs that serve open source programs, educational institutes and startups and seeks to expand the impact GitLab, the product, can have on organizations. Second, GitLab is dedicated to supporting charitable organizations with missions that align with our company’s values. For example, in September 2021, our board of directors approved the reservation of up to 1,635,545 shares of our Class A common stock for issuance to charitable organizations, to be further designated by the board of directors. Our board of directors have approved an aggregate of $10,700,000 (in fiscal year 2024) and $11,826,865 (in fiscal year 2025) in shares of our Class A common stock to be donated in fiscal year 2024 and fiscal year 2025, respectively, to the GitLab Foundation. The GitLab Foundation is a global nonprofit organization associated with GitLab and seeks to improve individuals’ financial security through access to education, training and other opportunities.

Diversity, Inclusion & Belonging:

Diversity, Inclusion & Belonging is fundamental to the success of GitLab and is one of our core values. As a core value we work to ensure Diversity, Inclusion and Belonging is incorporated and considered in all that we do. We strive for a transparent environment where all globally dispersed voices are heard and welcomed and where people can show up as their full selves each day and can contribute to their best ability. With global organizations utilizing GitLab, we strive for a team that is representative of our users. GitLab has 10 Team Member Resource Groups (“TMRGs”). TMRGs are voluntary, team member-led groups focused on fostering diversity, inclusion and belonging within GitLab. These groups help team members build stronger internal and external connections; offer social, educational, and outreach activities; create development opportunities for future leaders; and increase engagement among team members.

We're a team of passionate people who want to see each other, GitLab, and the broader GitLab community succeed. We care about what our team members achieve: the code shipped, the user that was made happy, and the team member that was helped. Our entire workforce is remote, allowing people of all backgrounds and abilities to join our team. As GitLab has grown, we’ve learned a lot about what it takes to build and manage a fully remote team and we share what we learn with anyone in the world with our Guide to All Remote.

Building a diverse and inclusive open source community takes time, effort, intentionality, and persistence. And it’s an investment we are committed to continue both externally and for our team members, together, one year at a time.

GITLAB INC.

Address Not Applicable

PROXY STATEMENT FOR THE

2024 ANNUAL MEETING OF STOCKHOLDERS

April 30, 2024

INFORMATION ABOUT SOLICITATION AND VOTING

The accompanying proxy is solicited on behalf of the board of directors of GitLab Inc. for use at our 2024 Annual Meeting of Stockholders (the “Annual Meeting”) to be held virtually at www.virtualshareholdermeeting.com/GTLB2024.Stockholders may log in 15 minutes prior to the meeting on Tuesday, June 11, 2024 at 8:30 a.m. Pacific Time, and any adjournment or postponement thereof. The Notice of Internet Availability of Proxy Materials and this proxy statement for the Annual Meeting (the “Proxy Statement”) and the accompanying form of proxy were first distributed and made available on the Internet to stockholders on or about April 30, 2024. An annual report to stockholders for the fiscal year ended January 31, 2024 is available with this Proxy Statement by following the instructions in the Notice of Internet Availability of Proxy Materials. In this Proxy Statement, we refer to GitLab Inc. as “GitLab,” “we,” “our,” or “us.” References to our website in this Proxy Statement are not intended to function as hyperlinks and the information contained on our website is not intended to be incorporated into this Proxy Statement.

INTERNET AVAILABILITY OF PROXY MATERIALS

In accordance with SEC rules, we are using the Internet as our primary means of furnishing proxy materials to stockholders. Consequently, most stockholders will not receive paper copies of our proxy materials. We will instead send these stockholders a Notice of Internet Availability of Proxy Materials with instructions for accessing the proxy materials, including our Proxy Statement and annual report, and voting via the Internet. The Notice of Internet Availability of Proxy Materials also provides information on how stockholders may obtain paper copies of our proxy materials if they so choose. We believe this rule makes the proxy distribution process more efficient, less costly, and helps in conserving natural resources.

GENERAL INFORMATION ABOUT THE MEETING

Purpose of the Annual Meeting

You are receiving this Proxy Statement because our board of directors is soliciting your proxy to vote your shares at the Annual Meeting with respect to the proposals described in this Proxy Statement. This Proxy Statement includes information that we are required to provide to you pursuant to the rules and regulations of the SEC and is designed to assist you in voting your shares.

We intend to ensure that our stockholders are afforded the same rights and opportunities to participate virtually as they would at an in-person meeting. We believe the virtual format makes it easier for stockholders to attend, and participate fully and equally in, the Annual Meeting because they can join with any internet-connected device from any location around the world at no cost. Our virtual meeting format not only aligns with our all remote culture, it also helps us engage with all stockholders — regardless of size, resources, or physical location, saves us and stockholders’ time and money, and reduces our environmental impact.

Record Date; Quorum

Only holders of record of our Class A common stock and Class B common stock at the close of business on April 15, 2024 (the “Record Date”) will be entitled to vote at the Annual Meeting. At the close of business on the Record Date, we had 132,547,710 shares of Class A common stock and 26,365,064 shares of Class B common stock outstanding and entitled to vote. For ten days prior to the Annual Meeting, a complete list of the stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder for any purpose relating to the Annual Meeting during ordinary business hours at our website: www.virtualshareholdermeeting.com/GTLB2024.

The holders of a majority of the voting power of the shares of our Class A common stock and Class B common stock (voting together as a single class) entitled to vote at the Annual Meeting as of the Record Date must be present at the Annual Meeting in order to hold the Annual Meeting and conduct business. This presence is called a quorum. Your shares are counted as present at the Annual Meeting if you are present and vote at the Annual Meeting or if you have properly submitted a proxy.

Participating in the Annual Meeting

•Instructions on how to attend the Annual Meeting are posted at www.virtualshareholdermeeting.com/GTLB2024.

•You may log in to the meeting platform beginning at 8:15 a.m. Pacific Time on June 11, 2024. The meeting will begin promptly at 8:30 a.m. Pacific Time.

•You will need the 16-digit control number provided in your proxy materials to attend the Annual Meeting at www.virtualshareholdermeeting.com/GTLB2024.

•Stockholders of record and beneficial owners as of the Record Date may vote their shares electronically during the Annual Meeting.

•If you wish to submit a question during the Annual Meeting, log into the virtual meeting platform at www.virtualshareholdermeeting.com/GTLB2024, type your question into the “Ask a Question” field, and click “Submit.” If your question is properly submitted during the relevant portion of the meeting agenda, we will respond to your question during the live webcast, subject to time constraints. Questions that are substantially similar may be grouped and answered together to avoid repetition. We reserve the right to exclude questions that are irrelevant to meeting matters, irrelevant to the business of GitLab, or derogatory or in bad taste; that relate to pending or threatened litigation; that are personal grievances; or that are otherwise inappropriate (as determined by the chair of the Annual Meeting). A webcast replay of the Annual Meeting, including the Q&A session, will be archived on the “Investor Relations” section of our website, which is located at ir.gitlab.com.

•If we experience technical difficulties during the meeting (e.g., a temporary or prolonged power outage), we will determine whether the meeting can be promptly reconvened (if the technical difficulty is temporary) or whether the meeting will need to be reconvened on a later day (if the technical difficulty is more prolonged). In any situation, we will promptly notify stockholders of the decision via www.virtualshareholdermeeting.com/GTLB2024. If you encounter technical difficulties accessing our meeting or asking questions during the meeting, a support line will be available on the login page of the virtual meeting website.

Voting Rights; Required Vote

In deciding all matters at the Annual Meeting, as of the close of business on the Record Date, each share of Class A common stock represents one vote and each share of Class B common stock represents ten votes. We do not have cumulative voting rights for the election of directors. You may vote all shares owned by you as of the Record Date, including (i) shares held directly in your name as the stockholder of record and (ii) shares held for you as the beneficial owner in street name through a broker, bank, trustee, or other nominee.

Stockholder of Record: Shares Registered in Your Name. If, on the Record Date, your shares were registered directly in your name with our transfer agent, Computershare Trust Company, N.A., then you are considered the stockholder of record with respect to those shares. As a stockholder of record, you may vote at the Annual Meeting or vote by telephone, through the Internet or, if you request or receive paper proxy materials, by filling out and returning the proxy card.